A Complete Guide to Hard Money Lending Terms for Real Estate Investors

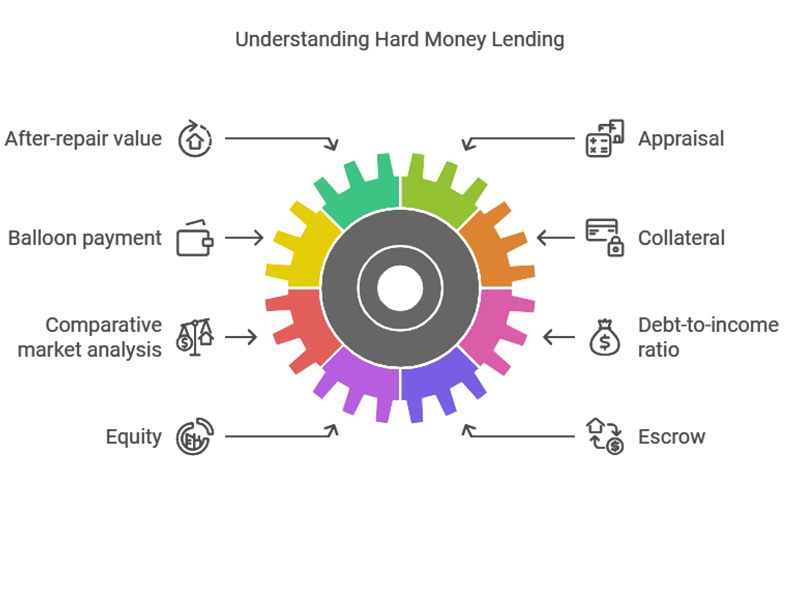

Getting a hard money loan should feel like something other than learning a new language.

But let’s be real – when lenders start talking about LTV, ARV and draw schedules, it can make your head spin.

That’s why we created this guide to property-based lending.

Whether you’re fixing up your first house, your first multi-family units, or have been investing in real estate for years, knowing these key lending terms puts you in control.

You’ll learn what matters when getting a loan, spot the important details in loan paperwork, and know what questions to ask lenders.

This guide will break down hard money lending terms into plain English.

We’ll walk through everything from interest rates to property requirements and show how these terms affect your real estate deals.

By the time you finish reading, you’ll talk about hard money loans as easily as you talk about your morning coffee.

To learn more about how hard money loans can fit into your investing strategy, check out our guides on fix and flip loans, bridge loans, and using collateral. And for personalized advice on your next deal, apply now with LM2 Investments – your trusted partner for hard money lending solutions

Key Takeaways:

- Hard money loans are short-term, asset-based loans funded by private investors.

- Interest rates are typically higher than traditional mortgages, ranging from 10-18%.

- Loan terms are usually 6-36 months, with interest-only payments and a balloon payment at the end.

- Lenders focus on the property’s value as collateral rather than the borrower’s creditworthiness.

- Understanding key terms like ARV, LTV, and origination fees is crucial for real estate investors.

Key Financial Terms – The Numbers That Matter

Interest Rate – The Cost of Borrowing

Think of this as the price tag on your loan. Hard money loans have higher interest rates, usually running from 8% to 12%, which is higher than a traditional loan. These loans move fast and focus more on the value of a property as collateral rather than your credit score.

Your rate depends on a few things:

- How risky the deal looks

- Your track record fixing houses

- How much of your own money you’re putting in

- What kind of shape the property is in

Points and Fees – The Upfront Costs

Points are the fees you pay when you get your loan. One point equals 1% of your loan amount. So, on a $100,000 loan, each point costs you $1,000. Most hard money loans charge between 2-4 points.

Watch out for these common fees:

- Origination fee (this covers processing your loan)

- Broker fee (if you’re using a loan broker)

- Document prep fees

- Inspection fees

- Title and escrow costs

Loan-to-Value (LTV) – How Much You Can Borrow

LTV ratios tell you how much a lender will loan compared to your property’s value. Most hard money lenders stick to 65-75% LTV. Here’s what that means:

If your property is worth $200,000 and the lender offers 70% LTV, you could borrow up to $140,000. The rest—$60,000 in this case—needs to come from you or another source.

Your real estate market can also come into play here.

After-Repair-Value (ARV) – The Future Worth

ARV is what your property should be worth after you fix it up. It’s huge because some lenders will loan based on this number instead of the current value.

Let’s say you find a $200,000 fixer-upper that’ll be worth $300,000 after repairs. A lender who loans 70% of the ARV might lend up to $210,000—enough to buy the property and pay for some repairs.

Timeline and Duration – When Things Happen

How Long These Loans Last

Most hard money loans run for 6-18 months. That’s usually enough time to buy a property, fix it, sell it, or refinance. But here’s what you need to know:

- Fix and flip loans typically last 12 months

- Bridge loans might go for 6-9 months

- Rental property loans can stretch to 24-36 months

- Extensions are possible but usually cost extra

Draw Schedule – Getting Your Repair Money

You will only get it once if you’re borrowing money for repairs. Instead, you’ll get it in “draws” – portions of money released as work gets done. Here’s how it usually works:

- First draw comes at closing – often 25-50% of repair funds

- Middle draws after specific work is finished

- Final draw when everything’s complete

Each draw needs:

- Pictures of the work done

- Receipts or contractor invoices

- A quick inspection (usually)

- Some paperwork

Important Dates to Watch

Missing deadlines can cost you money or cause headaches. Keep an eye on:

- When monthly payments are due

- How many days do you have to request draws

- When your loan matures (comes due)

- Deadlines for asking for more time

Pro tip: Add these dates to your phone calendar right after closing. Late fees aren’t fun; missing the maturity date can lead to big problems.

Property Requirements – What Lenders Care About

What Kind of Property Works

Hard money lenders aren’t picky about property conditions – that’s one of their best features. But they do care about:

- Location (they like properties in stable areas)

- Access (the property needs a clear way to get to it)

- Property type (houses, apartments, commercial buildings)

- Zoning (it has to be legal for what you plan to do)

Some properties are harder to finance:

- Raw land

- Properties that can’t be lived in

- Weird uses (like bowling alleys or churches)

- Places with serious problems (like bad foundations)

Lien Position – Who Gets Paid First

Your lender wants to be first in line to get paid if something goes wrong. That’s called the first lien position. Here’s why it matters:

- First position gets paid first if the property sells

- Most hard money lenders must be in first position

- Second position loans cost more (if you can find them)

- Other liens can cause problems at closing

Property Value – What’s It Worth?

Lenders need to know two values:

- What it’s worth now

- What it’ll be worth after repairs

They might check values using the following:

- Full appraisals (the most detailed)

- Broker price opinions (faster and cheaper)

- Sales of similar properties nearby

- Local market research

Your repair plan needs to make sense. If houses in the area sell for $200,000, planning $100,000 in fancy upgrades won’t work.

Paperwork – What You Need to Provide

What They Need From You

Don’t worry – hard money lenders care less about paperwork than banks. But they still need:

Must-Have Items:

- ID (driver’s license or passport)

- Proof you can make payments

- Basic info about your experience

- Papers showing where your down payment comes from

Nice-to-Have Items:

- Track record of past deals

- List of your other properties

- Bank statements

- Tax returns (sometimes)

Business Setup

Most lenders want you to borrow through a company rather than personally. This usually means:

- An LLC or corporation

- A business bank account

- Insurance in the company name

- Simple company paperwork

Your Exit Plan

Lenders want to know how they’ll get paid back. Common exit plans are:

- Fix and sell the property

- Rent it and refinance with a bank

- Wholesale it to another investor

Whatever your plan, be ready to explain:

- How long it will take

- What you’ll do if Plan A fails

- Who’s helping you (contractors, agents, etc.)

- Why your plan will work in your market

Pro tip: A solid backup plan makes lenders feel better about working with you. Please always have a Plan B ready to talk about.

Getting Your Loan – The Process

Getting Your Loan Approved

The good news? Hard money loans move fast – usually just 5-7 business days.

Note: The LM2 Investment Group can approve and fund your loan in 24 hours

Here’s what happens:

First Steps (1-2 days):

- Fill out a basic form

- Send pictures of the property

- Share your repair plan

- Show proof of funds for down payment

Middle Steps (2-3 days):

- Lender checks the property value

- Title company starts their work

- You send any missing paperwork

- Lender reviews everything

Final Steps (1-2 days):

- Get your loan papers

- Sign everything

- Send in your down payment

- Get your keys and first draw

Closing Time

Closing is when you get your money. It’s pretty straightforward:

What You’ll Need:

- Photo ID

- Down payment (usually a wire)

- Insurance proof

- Your signing hand!

What You’ll Get:

- Property deed

- Keys

- First draw (if you’re doing repairs)

- List of important dates

Pro tip: Most hard money closings happen at title companies. They’re much faster than bank closings – usually under an hour.

Staying Out of Trouble

Nobody plans to have problems, but knowing what to avoid helps:

Watch Out For:

- Missing payments

- Spending money on other things

- Not getting permits

- Changing plans without telling the lender

If you hit a snag:

- Call your lender right away

- Keep everything in writing

- Have a clear plan to fix things

- Stay in touch until it’s resolved

Keeping Things Safe – Risk Management

When Things Go Wrong

Nobody likes talking about problems, but it’s smart to know what happens if:

You Miss Payments:

- You’ll get late fees (usually after 5-10 days)

- The lender will call or email

- Interest keeps adding up

- You might get default notices

Your Project Runs Long:

- Tell your lender early

- Ask about extension options

- Be ready to pay extension fees

- Show your new timeline

Protecting Everyone

Insurance isn’t exciting, but it’s super important. You’ll need:

Basic Coverage:

- Property insurance (covers the building)

- Liability insurance (covers accidents)

- Flood insurance (if you’re in a flood zone)

- Builder’s risk (covers construction problems)

Smart Coverage Levels:

- Enough to rebuild the property

- At least $1 million in liability

- Coverage that starts the day you buy

- Named lender as “additional insured”

Pro tip: Don’t let insurance lapse – ever. Lenders check this and can charge you a lot for “force-placed” insurance if yours expires.

Keeping Records

Good paperwork habits save headaches:

Keep Copies Of:

- All loan documents

- Insurance papers

- Contractor bills

- Bank statements

- Before and after pictures

- All emails with your lender

Store Everything:

- In a special folder on your computer

- Backed up somewhere safe

- Easy to find when needed

- Organized by date

Different Deals, Different Rules

Types of Deals

Not all hard money loans work the same way:

House Flips:

- Usually 12-month loans

- Draws for repairs

- Interest-only payments

- Focus on after-repair value

Rental Properties:

- Longer terms (2-3 years)

- Lower rates (usually)

- Monthly principal and interest

- Care more about rent income

Land Deals:

- Higher down payments

- Shorter terms

- Higher rates

- Fewer lenders available

Experience Makes a Difference

The more deals you’ve done, the better your terms get:

First-Time Flippers:

- May need more down payment

- Higher rates

- More oversight on draws

- Might need a co-signer

Experienced Investors:

- Better rates

- Lower fees

- Faster approvals

- More flexible terms

- Might get multiple loans at once

Pro tip: Keep a portfolio of your past projects with before/after pictures and profits. It’s like a resume for real estate – lenders love seeing success stories.

Building Lender Relationships

Being a good borrower pays off:

Benefits of Track Record:

- Faster approvals next time

- Better rates

- More trust in draws

- Easier extensions if needed

- Might waive some requirements

Red Flags That Hurt You:

- Late payments

- Changing plans without telling them

- Not returning calls

- Messy paperwork

- Problem projects

What This All Means For You

Understanding hard money lending terms is about more than just knowing the lingo but making smarter deals. Let’s put it all together:

Quick Recap of What Matters Most:

- Rates and fees shape your costs

- Property value drives loan amounts

- Time frames keep you on track

- Good insurance protects everyone

- Experience helps you get better deals

Making Smart Moves

Use what you’ve learned to:

- Shop different lenders

- Spot good and bad loan terms

- Know what questions to ask

- Keep your projects on track

- Build solid lender relationships

Next Steps

Would you be ready to move forward? Here’s what to do:

- Figure out your numbers:

- Purchase price

- Repair costs

- After-repair value

- Timeline

- Get your paperwork ready:

- Property details

- Your experience

- Down payment proof

- Exit strategy

- Talk to lenders:

- Compare rates and terms

- Ask about their process

- Check their track record

- See if they’re a good fit

Need Help?

We’re here to answer questions and help you get started. You can:

- Call us at 480.444.2242

- Fill out our quick application form

- Chat with us on our chatbot.

Remember: The best deals happen when you understand the terms and work with lenders who match your needs. Take your time, ask questions, and ensure everything makes sense before signing.

Frequently Asked Questions About Hard Money Loans

What is the typical interest rate for a hard money loan?

Hard money loan interest rates typically range from 8% to 12%. Rates vary based on your experience, property type, and local market. First-time borrowers usually pay higher rates, while experienced investors often get better terms.

How much down payment do I need for a hard money loan?

Most hard money lenders require a 25-30% down payment for residential properties. You might need 30-40% down for commercial properties or land. The exact amount depends on:

- Property condition

- Your experience level

- Local market strength

- Property type

- Your exit strategy

How quickly can I get a hard money loan?

Hard money loans typically close in 5-7 business days. Here’s the usual timeline:

- Day 1-2: Application and basic documents

- Day 3-4: Property evaluation

- Day 5-6: Title work and final review

- Day 7: Closing and funding

What’s the minimum credit score needed for a hard money loan?

While credit scores aren’t the main focus, most lenders look for scores above 600. However, they care more about:

- Property value

- Your down payment

- Exit strategy

- Real estate experience

- Cash reserves

Can I get a hard money loan on a primary residence?

Yes, but with special rules. Due to federal regulations, you’ll need to:

- Prove you can’t get traditional financing

- Meet higher qualification standards

- Have a clear exit plan

- Use licensed lenders for residential loans

What is a draw schedule, and how does it work?

A draw schedule releases renovation funds in stages as work is completed. A typical schedule looks like:

- First draw (25-50%) at closing

- Second draw (25%) at 40% completion

- Third draw (25%) at 75% completion

- Final draw after completion

Each draw requires inspection and documentation.